Research by HR and payroll software provider Ciphr found that nearly a quarter (22%) of UK workers don’t regularly check their payslips. Despite their importance for keeping track of our pay, as many as one in twelve people (8%) admit that they rarely (or never) look at them.

So, why should we? And, what details do we need to check when we do? Ciphr asked payroll expert Julie Lally for some pointers. As MD of payroll at Ciphr, Julie and her team process payroll and BACS salary payments worth over £2 billion each year.

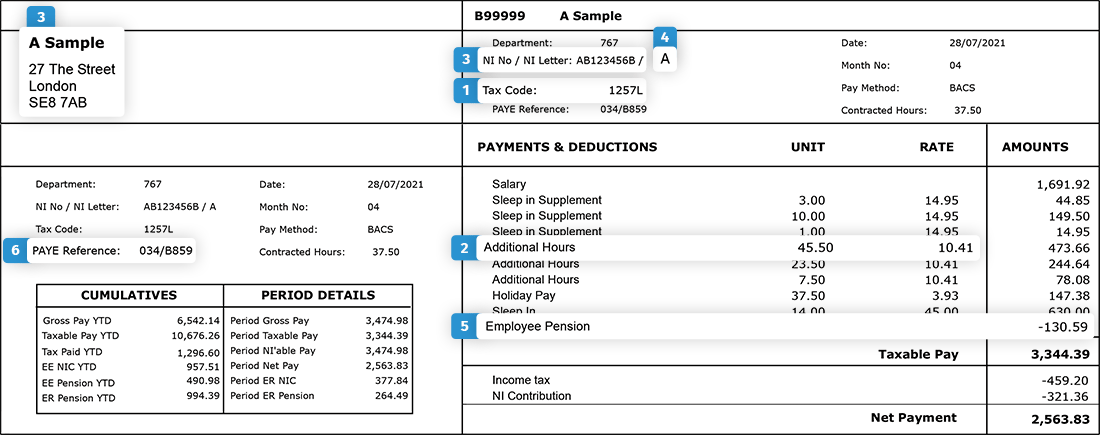

Here are her top five reasons why it’s essential to check payslips regularly:

1. Tax code

It’s worth remembering that it’s an employee’s responsibility to check they’re on the right tax code, as it impacts how much tax they pay – whether it’s too much tax or too little. Tax codes can, and do, change, particularly if there’s been a change of personal circumstances, such as people getting married, claiming taxable state benefits, or working from home.

For the 2024/25 tax year (and through to March 2028), the tax code for most people under 65 who only have one job or pension is 1257L. This means people can earn £12,570 tax-free, and only start paying tax on income over that amount. However, if they have any other form of income, get benefits-in-kind from their employer (health insurance, life insurance or a company vehicle etc) or claim tax relief for any other reason, it will affect this tax code.

Some of the most common tax code letters include: W1, M1, X, or BR which are usually temporary / emergency tax codes; S is used for Scottish taxpayers; C is used for Welsh taxpayers; NT means an employee pays no income tax; D0 or D1 denotes second jobs / pensions, and the M or N code means that people receive 10% of their spouse or partner’s personal allowance. (A full list is available at https://www.gov.uk/tax-codes/what-your-tax-code-means.)

A lot of payroll queries come from people who think they’ve paid too much tax in a particular month. Usually, it’s down to the tax code that HMRC sent through to payroll. Payroll can help with this – to help people understand what their tax code means or the implications of it. What they can’t do is say why HMRC issued that particular code, as it varies due to situations, age and earnings.

2. Variable payments

While the onus is on employers to pay their employees correctly, there is some responsibility on the employee to make sure that any variable payments, such as overtime or commission, are paid. Most people are on a cumulative tax code, so the code is constantly looking back at the previous month’s earnings in the tax year and making adjustments as it goes along. This process restarts at the beginning of each new tax year, which means it’s much easier to flag and fix any underpayments – and apply the right tax codes and National Insurance (NI) rates – in the tax year that the error happens, as opposed to a year or two later.

Overtime payments are now much easier to track, as there’s now a statutory requirement for employers to include a detailed breakdown of the rate and the hours worked. It’s still important that people check these details closely though.

Other variable payments to check each month include shared parental leave, contractual sick pay, statutory sick pay (SSP), statutory maternity pay (SMP), statutory paternity pay (SPP), and statutory adoption pay (SAP). People on maternity leave, for example, will tend to receive variable pay each month because it’s paid in weekly blocks. There may also be agreements in place that a certain number of weeks are paid at a higher rate. Some employers also top these payments up.

There are also deductions to consider, such as variable deductions like student loan repayments, which can change month to month if linked to income, or fixed deductions for things like trade union subscription fees or season-ticket loan repayments.

3. Personal details

Are your name and address correct on your payslip? Is your National Insurance (NI) number correct? What gets processed by payroll gets sent to HMRC and if they are reporting earnings under the wrong NI number, for example, it can cause problems down the line. HMRC stores a history of everyone’s National Insurance contributions (NICs), which builds up entitlement to a basic state pension, under their NI number (which is unique to them). If there’s been a mix-up and those contributions have been stored under the wrong NI number – where one person’s earnings have been reported under someone else’s NI number, it’s far from ideal. HMRC do usually flag any mistakes like this, but, again, it’s an employee’s responsibility to check.

4. National Insurance (NI) category letter

The most common National Insurance (NI) category code is A, which applies to all employees over 21 to state pension age. This is another important detail to check on a payslip, as it will impact the NI rate that people pay. The main rate of NI contributions is now 8% (reduced from 10% from 6 April 2024).

Employees over state pension age shouldn’t pay any NI (unless they are self-employed). Their NI letter is C. Other common NI letters include M for people under 21, H for apprentices under 25, B for married women and widows who opted in (pre-1977) to pay a reduced NI rate, and J and Z for employees already paying NI in another job.

Employees who earn less than £242 per week from one job won’t pay NI on their income.

5. Pension payments

Since pension auto enrolment was introduced in 2012, more people than ever have pension deductions – employee and employer pension contributions – showing on their payslips.

It can get a bit complicated for employees who opt into salary sacrifice or salary exchange pension schemes, particularly for the first time, as there might be some unexpected differences in gross pay and taxable pay. This is because when someone is on salary sacrifice, they sacrifice or exchange a portion of their salary to be paid directly into their pension and they get tax and NI relief on that portion. For people who aren’t sure how this has been calculated, it’s best to speak to their HR team as they usually have examples to illustrate how salary sacrifice impacts the salary amount that’s listed on a payslip.

Unless people have opted out, most payslips list employer contributions as ‘ER pension’, and employee contributions as ‘EE pension’, so it’s easy to spot. Sometimes it will also list the total pension contributions for the current tax year to date (YTD), along with total earnings and how much tax and NI has been paid.

What else should I check on my payslip?

By law, all employees and workers, unless they are self-employed, or work for the police or armed forces etc, must receive a payslip. It can be printed out and sent to them, or securely emailed as a pdf, or available online via their organisation’s self-service HR platform. Every payslip must show an employee’s total or gross pay, their net or take-home pay, any deductions or payments, and list any variable hours that have been worked.

Although payslips vary, they will also include a NI number, tax code, payroll number, pay rate, details of extra payments (overtime or bonuses etc), the tax month (the tax year starts in April, so that’s month one), the payment method, and a tax office / PAYE reference (#6 on the pay slip example above), which is useful to have when contacting HMRC with any queries.

Some employers can also use payslips to share important messages with staff. So that’s another good reason to check payslips regularly.

Are there any important times to check my payslip?

Always check your payslip carefully in April. There’s generally an uplift of the tax code at the start of the next tax year, which increases personal tax allowance (although, the personal tax threshold is set to stay frozen at 1257L until 2028).

March – the end of the tax year – is also a good time to check, particular for people required to submit tax returns. While a P60 can also be used for this, the figures will be the same as those on a March / month 12 payslip.

Essentially, it’s good practice to check payslips anytime there’s been a change in circumstances, such as an annual pay rise, a promotion, bonus payments, and commission payments. Anything that is likely to change earnings, tax codes or NI letters, for example.

Do I need to keep my payslips?

For employees, there’s no requirement to keep payslips for any specific length of time. But, for many people, it makes sense to keep a few years of payslips. For example, if people are applying for a mortgage or rental, then at least the last three months of payslips are required as proof of income. While employees who earn bonuses or commissions will need up to three years of payslips. If people need to submit a tax return every year, they might want to file a few years’ worth of payslips. As many employers now provide payslips digitally, it’s easier than ever to keep them rather than a stack of paper copies.

Old payslips, from 10-15 years ago, don’t really serve any practical purpose but it can be nostalgic to look back on them.

Payroll providers, on the other hand, are obliged to keep copies of pay run reports, which payslips are part of, for three years from the end of the tax year they relate to by HMRC.

Note: It is also good practice for employees to keep three years of historical P60s for use if applying for finance. Your P60 is an annual statement of earnings, which is issued to you by your employer.

What if there’s an issue with my payslip?

If an employee has a query about a payment on their payslip regarding overtime or commission, then they should go to their line manager, or possibly the HR team, in the first instance.

But if the query is about any of the statutory parts of the payslip – tax code, student loans or NI letter – employees should come to their payroll team or outsourced payroll provider. For example, if an employee is questioning a tax code change or why they’ve had student loan deductions on a particular month, payroll can advise them that HMRC requested it. Whereas an employee’s line manager wouldn’t know that information.

If there are any mistakes on the payslip, remember to flag it as soon as possible. It’s more complicated to fix issues retrospectively, particularly in a different tax year.

This article was first published in December 2021. It was updated in April 2024 for freshness, clarity, and accuracy. Please note: the payslip shown is for illustrative purposes only, and the NI calculations are not up-to-date.

Payroll trends 2025: predictions, challenges and solutions

What will 2025 have in store for the world of payroll? A lot can happen in 12 months, but Ciphr’s own experts, as well as payroll professionals...

Roundup of payroll changes 2025/26: everything you need to know

6 April is fast approaching – and that means that payroll professionals are gearing up for tax year end. It’s one of the busiest times of the year,...

Five reasons business leaders in the UK outsourced payroll - and why you should, too

Every member of the C-suite has a vested interest in ensuring payroll runs in a smooth, secure and efficient manner. For some organisations, the...