As we begin 2026, benefits professionals, HR teams and payroll leaders are being pulled in multiple directions. Employees are feeling the ongoing impact of rising living costs. Expectations around wellbeing, flexibility and personalisation continue to grow. At the same time, organisations are under pressure to control spend, navigate regulatory change and demonstrate real value from their benefits investment.

So where should benefits teams focus next?

To help answer that question, we surveyed over 100 benefits, HR and payroll professionals across the UK to understand the trends, pressures and priorities shaping the benefits landscape in 2026. The results offer a clear picture of what’s changing – and where organisations will need to adapt.

Employee benefits trends 2026: the big picture impacting benefits

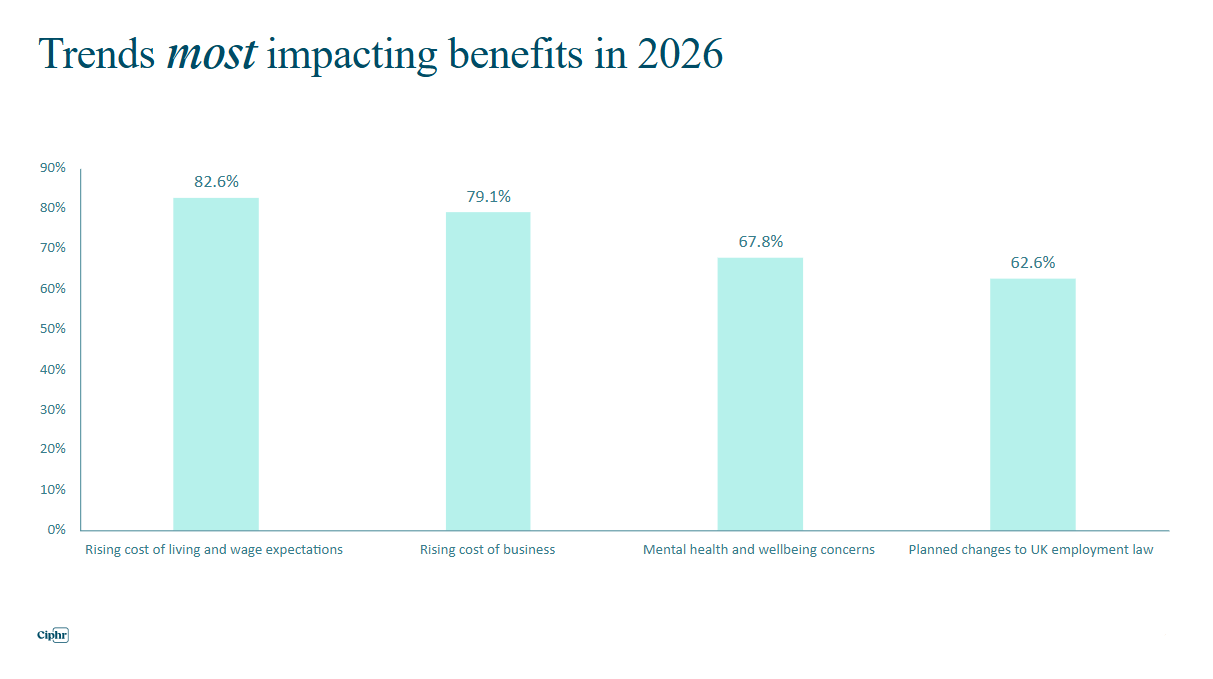

Which trends will most impact benefits teams in 2026?

Unsurprisingly, cost pressures dominate – but they’re far from the only concern. Respondents told us that these trends will have the greatest impact on benefits teams in 2026:

- Rising cost of living and wage expectations – 82.6% expect a moderate or significant impact

- Rising cost of business – 79.1%

- Mental health and wellbeing concerns – 67.8%

- Planned changes to UK employment law – 62.8%

Together, these pressures underline the challenge benefits teams face: doing more to support employees while managing budgets carefully and staying compliant.

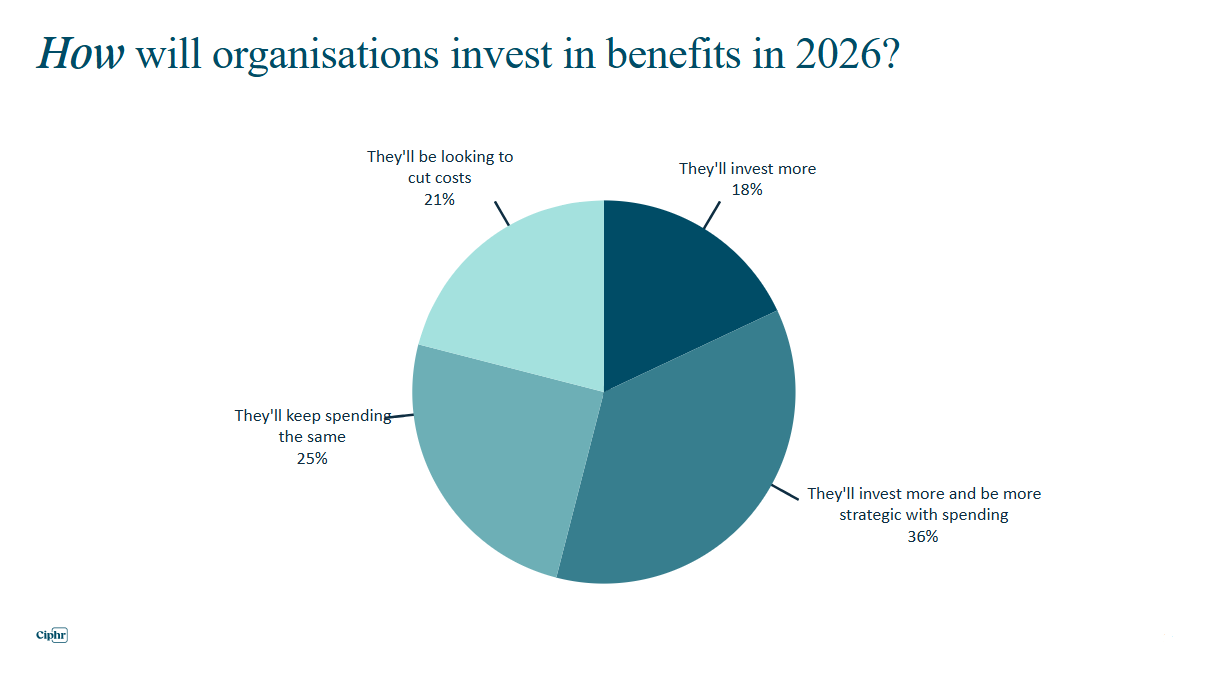

How will organisations invest in benefits in 2026?

Despite economic uncertainty, many organisations are planning to stay the course – or invest more strategically:

- They’ll invest more and be more strategic with spending – 36% of respondents

- They’ll keep spending the same – 25%

- They’ll be looking to cut costs – 21%

- They’ll invest more – 18%

This suggests a shift away from blanket spending increases, towards more targeted, data-led benefits strategies.

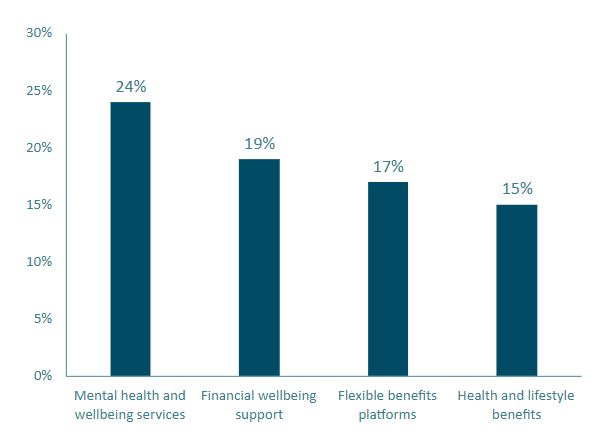

Which areas of benefits functionality or services will see more investment in 2026?

When asked where organisations expect to focus their benefits investment in 2026, four clear priorities emerged:

- Mental health and wellbeing services – 24% of respondents

- Financial wellbeing support – 19%

- Flexible employee benefits platforms – 17%

- Health and lifestyle benefits – 15%

The emphasis is firmly on flexibility, wellbeing and relevance – rather than one-size-fits-all benefits.

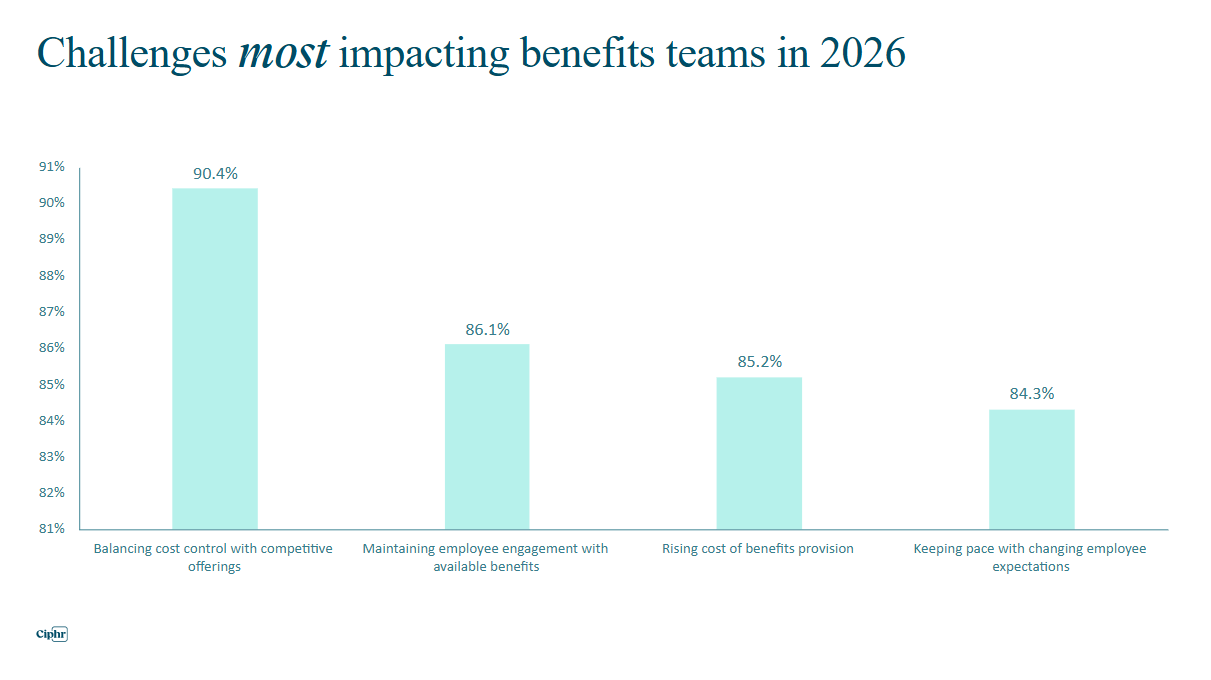

What will drive benefits investment in 2026?

While investment will continue, benefits teams expect it to come with challenges. Respondents highlighted several factors that will make benefits decisions more complex:

- Balancing cost control will competitive offerings – 90.4% say this will be somewhat or significantly challenging

- Maintaining employee engagement with available benefits – 86.1%

- Rising cost of benefits provision – 85.2%

- Keeping pace with changing employee expectations – 84.3%

These challenges point to a growing need for smarter systems, clearer insight and stronger communication.

Employee benefits trends 2026: challenges benefits teams will face

Below, we explore the four biggest challenges benefits teams expect to face in 2026 – and how organisations should respond.

Challenge 1: balancing cost control with competitive offerings

Benefits teams are under pressure to manage rising costs while still offering packages that attract and retain talent.

- Increasing costs of benefits provision

- Pressure to stay competitive in tight labour markets

- The need for cost-neutral or salary sacrifice options

- Difficulty measuring ROI

- Time-consuming administration

How organisations should respond:

- Use flexible benefits platforms to control spend

- Take a more data-driven approach to optimisation

- Offer broader, more personalised benefits packages

- Streamline administration through integrated systems

- Use analytics and reporting to demonstrate value

Challenge 2: maintaining employee engagement with available benefits

Even the best benefits don’t deliver value if employees don’t understand or use them.

Common challenges include:

- Low awareness or understanding of benefits

- Benefits that feel irrelevant to different employee groups

- Disjointed or complex user experiences

- Inconsistent or one-off communications

- Difficulty tracking engagement

Potential solutions include:

- Clear, ongoing benefits communication and education

- Tailored and flexible benefits options

- A single, user-friendly digital platform

- Automated, data-triggered communications

- Better use of analytics to track engagement and uptake

Challenge 3: rising cost of benefits provision

Rising insurance premiums, healthcare costs and national insurance (NI) changes are putting additional strain on budgets.

Challenges include:

- Escalating provider costs

- Pressure to maintain competitiveness

- Limited cost-neutral benefit options

- Complexity in managing and forecasting spend

- Communicating value to employees

Approaches organisations can take:

- Expand salary sacrifice and cost-neutral benefits

- Use modular, flexible platforms

- Improve cost visibility through better data

- Integrate benefits with HR and payroll systems

- Focus on clearer employee communication

Challenge 4: keeping pace with changing employee expectations

Employee expectations around benefits continue to evolve – and quickly.

Key challenges include:

- Rapidly changing needs across different demographics

- Demand for flexibility and personalisation

- Greater focus on wellbeing and inclusion

- Difficulty adapting benefits quickly

- Communication gaps

How benefits teams can respond:

- Introduce flexible, modular benefits platforms

- Regularly refresh and update offerings

- Enable faster rollout of new benefits

- Prioritise wellbeing and inclusion

- Maintain consistent, ongoing communication

Hear directly from our experts

To explore our benefits trends in more depth, along with what HR and payroll can expect in 2026, check out these webinars:

From our research of 2026 employee benefits trends and challenges, one thing is clear: employee benefits are no longer just a cost to manage. They’re a strategic tool for supporting wellbeing, engagement and retention.

Benefits teams that succeed will be those that combine flexibility with control, use data to guide decisions, and make it easy for employees to understand and engage with what’s on offer. Technology will play a critical role in making this possible, helping organisations adapt quickly while keeping costs in check.

If you’d like to see how we can support your benefits strategy in 2026 and beyond, book a demo of our employee benefits platform or download our benefits factsheet.